5 Simple Techniques For Atlanta Hard Money Lenders

Wiki Article

6 Easy Facts About Atlanta Hard Money Lenders Shown

Table of ContentsAtlanta Hard Money Lenders for DummiesAtlanta Hard Money Lenders for BeginnersSome Of Atlanta Hard Money LendersThe Single Strategy To Use For Atlanta Hard Money LendersThe 3-Minute Rule for Atlanta Hard Money LendersWhat Does Atlanta Hard Money Lenders Do?

Oftentimes the approval for the tough cash financing can happen in just one day. The tough cash lender is going to consider the home, the quantity of down payment or equity the debtor will have in the building, the consumer's experience (if relevant), the leave strategy for the property and also ensure the customer has some cash gets in order to make the month-to-month lending payments.Investor who haven't previously utilized difficult cash will certainly be surprised at how promptly difficult money finances are funded contrasted to banks. Contrast that with 30+ days it takes for a bank to fund. This speedy funding has actually conserved numerous genuine estate financiers who have actually been in escrow just to have their original lender draw out or just not provide.

Their list of needs enhances annually and also most of them seem arbitrary. Banks also have a listing of concerns that will certainly raise a warning and stop them from also considering lending to a debtor such as recent repossessions, brief sales, loan modifications, and bankruptcies. Negative debt is an additional aspect that will certainly prevent a bank from offering to a customer.

Unknown Facts About Atlanta Hard Money Lenders

The good news is genuine estate financiers that might presently have a few of these problems on their document, hard money lenders are still able to offer to them. The difficult cash loan providers can provide to debtors with problems as long as the borrower has enough deposit or equity (at the very least 25-30%) in the residential property.When it comes to a potential customer who wants to purchase a main residence with an owner-occupied tough cash car loan with a personal home mortgage lending institution, the debtor can originally acquire a property with difficult cash and afterwards function to fix any type of problems or wait the needed quantity of time to remove the concerns.

Banks are likewise reluctant to provide residence fundings to consumers who are freelance or currently lack the called for 2 years of employment background at their present placement. The borrowers might be an excellent prospect for the car loan in every other element, but these approximate demands avoid financial institutions from prolonging funding to the customers.

The Of Atlanta Hard Money Lenders

In the instance of the debtor without enough work history, they would certainly have the ability to re-finance out of the hard cash finance and into a lower expense conventional funding once they acquired the necessary 2 years at their existing setting. Tough cash loan providers offer lots of loans that standard lenders such as financial institutions have no interest in funding.

These projects entail an investor acquiring a residential or commercial property with a short-term lending so that the investor can promptly make the needed repair services and updates and afterwards sell the residential property. atlanta hard money lenders. The actual estate financier only requires a 12 month lending. Financial institutions wish to lend money for the long term and also are pleased to make a percentage of interest over a lengthy duration of time.

The issues can be related to foundation, electric or pipes and might trigger the financial institution to think about the home uninhabitable and incapable to be moneyed. and are not able to think about a lending situation that is beyond their strict financing standards. A tough money lending institution would have the ability to provide a consumer with a financing to acquire a home that has problems preventing it from getting a conventional small business loan.

All About Atlanta Hard Money Lenders

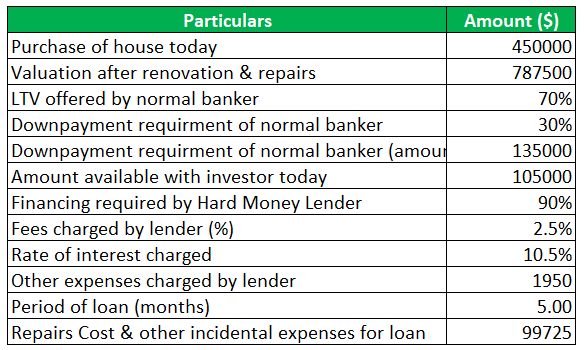

Hard money loan providers additionally click this site charge a car loan origination charge which are called factors, a percentage of the loan amount. atlanta hard money lenders. Points usually range from 2-4 although there are lending institutions who will charge much higher factors for specific circumstances. Specific areas of the country have numerous contending tough money lenders while various other areas have couple of.

In big city areas there are typically a lot more difficult money loan providers eager to lend than in farther country areas. Consumers can benefit substantially from inspecting rates at a few various lending institutions prior to devoting to a tough money lending institution. While not all tough cash loan providers use 2nd mortgages or trust acts on buildings, the ones who do charge a greater rates of interest on 2nds than on 1sts.

Some Known Details About Atlanta Hard Money Lenders

This enhanced passion price mirrors the raised threat for the lender being in 2nd setting instead of 1st. If the debtor goes right into default, the first lien owner can confiscate on the home and erase the second lien owner's passion in the residential property. Longer regards to 3-5 years are readily available however that is normally the top limit for finance term size.If rate of interest drop, the debtor has the choice of refinancing to the lower current rates. If the rates of interest boost, the debtor is able to keep their lower rates of interest finance and also lender is forced to wait up until the financing ends up being due. While the loan provider is awaiting the car loan to become due, their financial investment in the trust fund action is producing much less than what they might get for a new trust fund deed financial investment at present rates.

Some Known Facts About Atlanta Hard Money Lenders.

This is a worst instance scenario for the hard money lender. In a comparable situation where the consumer places in a 30% down settlement (rather of only 5%), a 10% decline in the worth of the residential or commercial property still gives the consumer lots of reward to stick to the home and job to shield their equity.Report this wiki page